Dilution And M&A Coming To Banks |

您所在的位置:网站首页 › fed tightening always breaks something importance of › Dilution And M&A Coming To Banks |

Dilution And M&A Coming To Banks

|

Sohel_Parvez_Haque There are a lot of negative narratives in the world right now. I don't just mean in financial markets. I mean everywhere. One of the lessons I've learned in nearly 3 decades of investing is that when the narratives get hot and heavy in one direction, it's time to start thinking about looking in the other direction. A scary narrative out there right now is that we are about to have a banking crisis. I think it's more of a transition to higher rates and real estate value resets. And, I think that the Federal Reserve and FDIC are handling it well - clearly not in line with the popular trader's narrative. So, rather than selling bank stocks now, I'm considering buying some. That's a rarity for me, as the only other time I have bought banks more than at index level allocations was 2009. Breakage In The BanksI have used the phrase "until something breaks" dozens of times since just before the Federal Reserve starting QT (quantitative tightening) started. The point I have been making was that QT would last until something broke. Here's a few primers on QT and proof that what has been happening was forecastable without a magical voodoo trading system. In the space of three weeks, months before the Fed started tightening, I wrote these The Fed Warned You, Are You Going To Fight The Fed? Overvalued, Overbought & Overleveraged Market While The Fed Tightens, What Could Go Wrong? Macro Dashes: The Fed Is Reloading Its Bazooka For Next Time. I will come back to how to think about QT in a few minutes. But first, let's talk about the fact that something finally did break. In fact, a couple things broke. The first thing that broke was SVB Financial Group (OTC:SIVBQ), which went under in a matter of days after it could not raise capital. Management knew of the problems for months, and their share sales were quite curious leading up to the collapse. As a tight knit group of rich chattery clients became concerned, they started to pull money from SVB. Then, a few questionable actors poured gasoline on the camp fire with rumors and turned it into a full-blown conflagration - and a run on the bank began. In one day, over $40 billion left SVB. The next day, SVB became the 2nd biggest bank collapse in U.S. history, after Washington Mutual in 2008 during the Financial Crisis. Next up was Signature Bank (OTC:SBNY), which had increasingly turned to speculative investments. These included crypto and private equity lending, which they did not have great experience with. While risk rose, so did the compensation of the executives. Curious how that always seems to follow, or at least I've noticed it the past 30 years. As risks turned into losses, the bank's stock drifted down. Then, a day after SVB collapsed, Signature did as well, becoming the 3rd biggest bank collapse in U.S. history. Keep this in the back of your head. Only about a month ago, the second and third biggest bank collapses in U.S. history happened, within days of each other, and it's barely news now. Take a look at the iPath® Series B S&P 500® VIX Mid-Term Futures™ ETN (VXZ), which is a measure of short-term volatility risk.

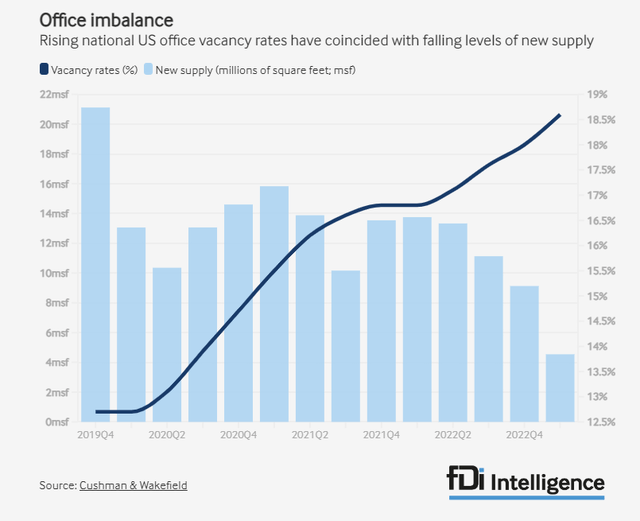

VXX (Kirk Spano) How, in a matter of weeks, did the stock market completely shrug off these two major bank collapses? Well, I think there's a couple reasons. And, I'll note, the little old ladies did not bring up the bank collapses in all their negative narratives. Where Do Banks Go Next?I think an important question to ask is will the banking crisis get worse? The answer is probably not, in my opinion. I laid out my case in this piece a few weeks ago: The Fed Did What You Asked For With Silicon Valley Bank. A couple days ago, here's what JPMorgan Chase (JPM) CEO Jamie Dimon said to CNN asking him if there could there be more bank failures: “I don’t know... But if there are, honestly, they’ll be resolved. I think we’re getting near the end of this particular crisis.” That doesn't mean I think bank stocks are ready to be bought. It also does not mean I think banks are in the clear. It just means that I don't see a crisis looming. I don't think there is a crisis looming because everyone knows what is coming the next couple years: Refinancing of commercial real estate loans. A lot of them. Here's the skinny. It's the regional banks that have the most exposure to commercial real estate loans as a percentage of their assets. Why is that bad? Very simply, because they are going to get the keys back on some of those buildings. With the nearly a quarter of the U.S. workforce now working at home at least part time, occupancy rates are around 55%-60% all over the country and there's a new record on outright vacancies.

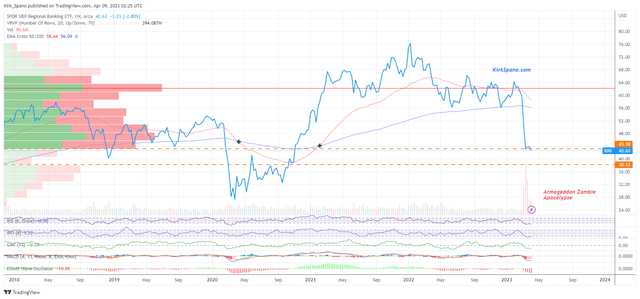

CRE Vacancy Record (Cushman & Wakefield) More about real estate when I talk about the big funds from operations ("FFO") risk in commercial and some residential real estate investment trusts ("REITs"). For the regional banks, this means a lot of pressure on their balance sheets. Those buildings are not going to sell for enough to cover the loan balances. I personally know of at least 5 private equity groups, nine figure types, that are looking to buy these buildings once the banks take possession. But, I can assure you, they are looking for bargains. Same goes for KKR & Co. Inc. (KKR) and Blackstone Inc. (BX). They'll be buyers of the biggest buildings. Which is sort of ironic, since Blackstone has given the keys back on two properties the past year. So, what does that mean for regional banks. Two things: Dilution M&A.Ultimately, things work out. The Fed and FDIC have already drawn the line in the sand and will not allow a panic. Bank stocks, and some bonds, will be allowed to go to zero, though. And, that is why moral hazard has been decreased. Taking risks to raise short-term revenues and growth, which pushes executive compensation up, won't fly anymore. Most importantly, though, the Fed is backing mergers of broke banks into stronger banks. Take a look at the SVB deal closely. That's as close to a no-lose situation for the acquiring bank, First Citizens BancShares, Inc. (FCNCA), as you can get. I remember the Financial Crisis well. I know a few local bank Presidents (or they were at the time) whose banks were essentially given other banks, with the Fed and FDIC taking on literally 90 to 99% of the risk. You'll almost certainly see several of those deals in the next year or two. Take a look at the SPDR S&P Regional Banking ETF (KRE). It is currently off its high from 2021 by over 40%. You can see on this weekly time frame chart that RSI is very oversold.

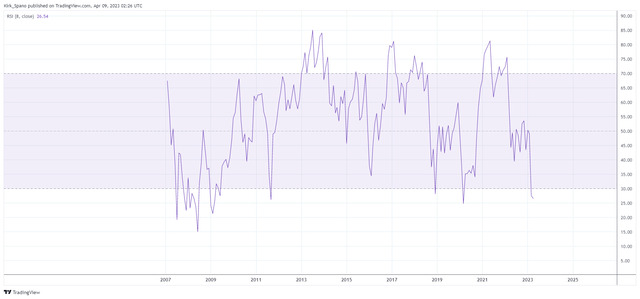

KRE Weekly Technicals (Kirk Spano) On a monthly time frame, RSI has just gotten oversold and seems like it could chop along a bit. But, it is low enough that we ought to be thinking about when is the right time to buy.

KRE Monthly RSI ( Kirk Spano) In looking at bank balance sheets, it is clear that a lot of consolidation can happen in the space without draconian dilution. It's only the very weak that will be diluted to zero or nearly zero. Jaimie Dimon of JPMorgan once offered $2 per share to Bear Stearns, mainly to acquire their NYC building. There will be a few deals like that. To me, KRE seems to have some downside left. How much is the question? My clients and subscribers know I do not like investing in banks. Too cyclical for me without the upside punch of other cyclicals. However, there are two times I buy banks. The first is when I find a super strong local bank that looks likely to expand its footprint. I've bought a few banks supported by the dairy, timber, and oil industries in the past and done well. The second time I buy banks is when there is a dislocation. I bought a few banks in 2009. That worked out. I plan to buy KRE soon to take advantage of the consolidation in regional banking and the next up cycle, which I think starts in the next year or two. I discussed my thoughts on the banking industry in a recent interview with Seeking Alpha: How To Avoid Losing Money Through The Volatility. 2 Banks Of Interest So FarThis is just a brief mention, but, I think you should do your research on these two banks: First Republic Bank (FRC) Fifth Third Bancorp (FITB).First Republic needs 80-90% dilution from what I can tell. The share price already reflects most of that. That bank was an acquirer and now needs to be acquired to repay about $30 billion to the big banks that gave them a credit life line last month. I have openly speculated that a great parent company would be Berkshire Hathaway Inc. (BRK.B). If they take ownership of 80% or more of the bank, they can absorb the bank's financials into their own financial reporting. That sort of transaction, even if it's not Berkshire, but rather some other giant rich company, could make the new bank the "apple" of many investor's eyes. Okay, I gave away the hint. I think Apple Inc. (AAPL) would also be a great parent company. What I know about rich families is that they often buy local banks. Apple could do that here. It would allow Apple to invest their own massive balance sheet a lot more strategically and drop the bank's financial reporting to their own balance sheet. If Apple doesn't come out of this mini-crisis, and really it's just a transition to normal interest rates, with a bank, I would be surprised. Consider this. If the Europeans are going to continue putting pressure on American big tech, and the U.S. Government partially follows suit, do you think there might be some sort of giveback? Could government try to create more competition in tech, but then give big tech, which is sitting on a hundreds of billions of dollars, a way to mitigate their tech losses, by letting them into banking at the moment banking needs a few bucks? If you don't, then you and I have very different ideas about the quid pro quo that government engages in with business. I know there are some legal and charter hurdles to get these sorts of transactions done, but it makes too much sense not to get done. One of my favorite pieces of wisdom, which I claim to have made up, but surely didn't, is that "things that make sense, eventually happen." I am also very interested in Fifth Third Bancorp, which is in far, far better shape than First Republic. I would compare Fifth Third to First Citizens as very likely to receive a gift bank from the FDIC at some point. I love Fifth Third's footprint in the Midwest and Southeast. They have a combination of cash flow and growth that is very dynamic. Fifth Third would make sense as an acquirer for First Republic to jump into California. There's another half dozen regional banks I am looking at. More on them soon if publishing my notes makes sense as a precursor to buying stock. I do think I will be buying KRE sometime this year, though, and will have a full piece coming on in my Global Trends ETF report in the next month or two. Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Find out how we knew to raise cash for 2022 and what we plan to buy for the next bull market! Join us today to invest in a changing world with a Margin of Safety. Now 20% off your 1st year. ETF Asset Allocation, Growth Stocks, Dividend Growth, Low Volatility Retiree Dividend Stocks, REITs, Option Selling For Income & Alternative Income. |

【本文地址】

今日新闻 |

推荐新闻 |